What is operational leasing – The complete guide for entrepreneurs

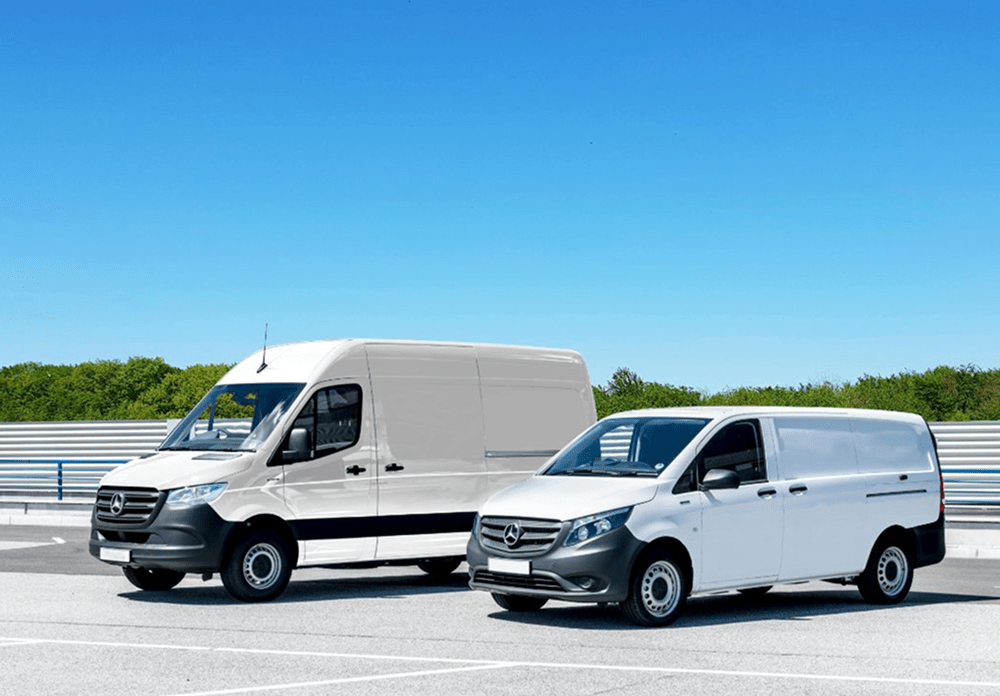

Operational leasing is an increasingly popular option for companies looking to expand their fleet without tying up capital in outright purchases. If you have a growing business and are looking for flexible solutions with predictable costs and simplified administration, this guide will help you understand how operational leasing works and what other options are available to you. We’ll explore the advantages of this solution, the types of leasing available and the alternatives suitable for small and medium-sized businesses.

- Definition of operational leasing

- How operational leasing works

- Advantages of operational leasing

- Operational leasing disadvantages

- Operational leasing vs financial leasing

- Who is operational leasing for

- Other options for fleet expansion

- Choose the right solution for your business

Definition of operational leasing

Operational leasing is a form of financing whereby a company can use new vehicles without purchasing them. Basically, vehicles are leased on a long-term basis from a specialized company and the user pays a fixed monthly rate. This usually includes insurance, maintenance, taxes and other administrative costs.

Unlike other financing methods, operational leasing does not involve transfer of ownership of the vehicle. The leasing provider remains the owner, and the company benefits from the use of the vehicle without the responsibilities associated with ownership. The model is designed to offer flexibility and reduce the logistical and financial effort required to manage a fleet of cars.

How operational leasing works

Operational leasing is a simple process designed to save time and ease fleet management. Here are the main steps:

- You choose the right vehicles for your business.

- You sign a fixed-term contract, generally between 1 and 5 years.

- You pay a fixed monthly rate that includes the use of the vehicle, maintenance costs, insurance, taxes and other services.

- You use the vehicles in the company’s day-to-day business.

- The leasing provider handles all administrative details: service, tires, roadside assistance, paperwork.

- At the end of the contract, you can return the vehicles, extend the contract or choose new ones, depending on your business needs.

This model enables efficient resource management and provides financial predictability without the complications associated with vehicle ownership.

👉 Managing a fleet is more than just choosing vehicles. This article gives you 10 practical recommendations for efficient organization and cost reduction. Discover a useful resource for any fleet manager.

Advantages of operational leasing

Operational leasing brings a number of practical benefits for companies that need a fleet of cars but do not want to invest in outright vehicle purchase. Among the most important advantages are:

- Predictable costs: fixed monthly rate allows clear financial planning without fluctuations caused by unexpected maintenance or repair costs.

- Modern fleet: access to new and efficient vehicles contributes to the company’s professional image and reduces fuel consumption.

- Flexibility: the possibility to adjust the number of machines according to the current needs of the business.

- No resale risks: at the end of the contract, the vehicle is returned to the supplier, eliminating the worry of depreciation and market value.

- Services included: the leasing company manages maintenance, insurance, taxes and other administrative operations.

- Tax benefits: the rates are considered operating expenses and may be fully deductible, depending on the applicable tax legislation.

These benefits make operational leasing an efficient and manageable option for businesses that depend on mobility.

Disadvantages of operational leasing

Although operational leasing offers many advantages, there are certain limitations that must be taken into account before signing a contract. Here are some of the possible disadvantages:

- Long-term costs: For very long-term vehicle use, the total cost paid through leasing may exceed the outright purchase value.

- Use limitations: Contracts may include restrictions on annual mileage and how the vehicle can be used, which may affect daily operations.

- Lack of ownership: the vehicle remains the property of the leasing company, and at the end of the contract there is no option to buy.

- Dependence on the supplier: The quality of the services provided depends on the reliability and professionalism of the leasing company, which can influence the overall experience.

These aspects should be analyzed according to the specific needs and objectives of each business. An informed decision helps avoid problems and maximize long-term benefits.

Operational leasing vs financial leasing

When a company is considering options for financing a fleet of cars, the two main solutions are operational leasing and finance leasing. Although both allow the use of vehicles under a fixed-term contract, the differences between them are essential and influence both cost management and long-term strategy.

Operational leasing is conceived as a flexible solution, ideal for companies that want a modern fleet without having to invest in the purchase. The vehicles are used for a fixed period (usually between 1 and 5 years) and all essential costs (maintenance, taxes, insurance) are included in the monthly rate. At the end of the contract, the cars are returned to the supplier, which eliminates any worries about resale or depreciation. In addition, expenses are considered operational and can be fully tax deductible.

Finance leasing, on the other hand, is closer to the idea of a purchase loan. The customer pays monthly installments but is responsible for all additional costs: maintenance, insurance, taxes. The contracts are usually longer (more than 5 years), and at the end, the user can become the owner of the vehicle. This solution is suitable for companies that want to keep their vehicles for the long term and are prepared to take over their complete management.

The choice between operational leasing and finance leasing depends on your business objectives, growth plan and available resources. For companies looking for flexibility, predictable costs and efficient fleet management, operational leasing may be a better choice. In contrast, financial leasing can offer long-term advantages in situations where vehicle ownership is essential.

Who is operational leasing for

Operational leasing is a solution tailored to the varied needs of companies that use fleets of cars in their day-to-day business, but do not want to invest in outright purchase of vehicles. It is an ideal option for companies that want mobility, cost control and less bureaucracy in fleet management.

În mod special, beneficiaza de leasing operational:

- Small and medium sized companies looking to reduce fixed costs and avoid unforeseen expenses related to the maintenance of their vehicles;

- Growing businesses that need the flexibility to quickly adjust their fleet according to market demand or ongoing projects;

- Transport, distribution and logistics companies, for whom reliability and optimization of vehicle costs are essential to maintain competitiveness;

- Organizations that prefer to outsource their fleet management, thus focusing on their core business without spending time and resources on administrative or technical issues.

There are no rigid restrictions on eligibility, but leasing providers will assess the company’s financial capacity and payment history before approving the contract. For many businesses, operational leasing can be an effective tool for growth and adaptation, especially in a dynamic economic environment.

Other options for fleet expansion

Operational leasing is an efficient and increasingly popular solution for fleet management, but it is not the only option available. Depending on the specifics of your business, the volume of activity and your financial resources, there are several options that can respond differently to your company’s needs. It is important to be aware of all the alternatives before making a decision, in order to choose the most suitable formula in the current and long-term context.

1. Long-term car rental (mini leasing)

This option is a flexible solution for companies that need vehicles on a temporary basis without committing to a standard leasing contract. Long-term leases allow quick access to vehicles with adaptable periods of use – from a few months up to two years. It’s ideal for seasonal projects, temporary contracts, periods of testing new routes or rapidly growing demand. Plus, costs are predictable and maintenance is generally included.

👉 Mini Lease allows quick access to vehicles without long contracts, making it suitable for seasonal projects, short campaigns or periods of rapid growth. It offers control and mobility with minimal effort. Apply now!

2. Direct procurement

For companies that have the capital and want total control over their vehicles, outright purchase may be a suitable option. The cars become the company’s property and can be used without contractual restrictions. However, this model entails high upfront costs and full responsibility for maintenance, repairs, resale and logistics management. It is financially and operationally more rigid, but can make sense in certain contexts, especially in the long term.

3. Financial leasing

An alternative to outright purchase, financial leasing involves paying monthly installments for a longer period (usually 4-5 years), at the end of which the company can become the owner of the vehicles. This model is useful for companies that want to keep their cars and amortize them over time. However, the responsibility for maintenance, insurance and taxes lies entirely with the user, and flexibility is limited compared to operational leasing.

4. Mobility packages from specialized providers

More and more companies are opting for mixed mobility solutions, offered by providers that combine services such as operational leasing, short-term rentals, in-house car-sharing for employees or digital fleet monitoring solutions. These packages are tailor-made and can help companies optimize costs, increase efficiency and adapt quickly to market changes.

Depending on your growth objectives, pace of business development and operational model, each of these options may have specific advantages. For some companies, a combination of more than one solution – for example, operational leasing for the fleet base and long-term leases for peak periods – can provide the optimal balance between control, flexibility and cost.

Choose the right solution for your business

Operational leasing and other flexible mobility solutions can be effective tools for expanding a car fleet without tying up capital in acquisitions. These options offer the freedom to quickly adapt the fleet to changing market demands while ensuring cost control and operational efficiency.

👉 Enterprise provides mobility solutions for small and medium-sized companies. The combination of operational leasing, rental and integrated services helps to optimize the fleet without additional effort. Discover how you can streamline your company’s mobility.

Whether it’s traditional operational leasing, long-term rentals or customized services offered by specialized companies, the choice of the right solution should be based on specific business objectives, growth plans and resource management capacity. A careful comparative analysis of the advantages and limitations of each option is essential for making an informed decision.

For best results, evaluate all available options and request customized quotes from multiple suppliers. A well-chosen fleet management strategy allows the company to focus on core activities and service development.

Photo source: Pixabay, Unsplash, Pexels.